Nelson Capital Management

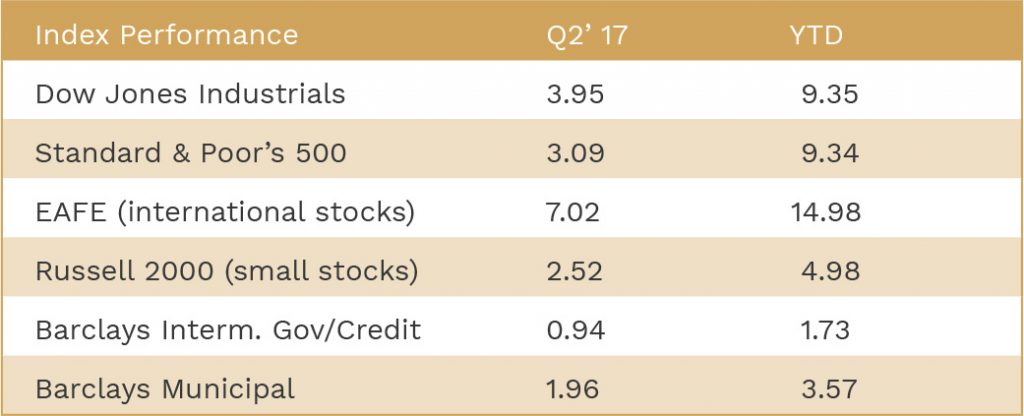

In the second quarter, world stock markets rose slowly but steadily, building on the first quarter’s gains. Except for two trading days in June, volatility was very low. Bond yields declined marginally, from 2.4 to 2.3% for the 10-year US Treasury, after reports showed tepid economic growth and benign inflation. Real bond yields, the difference between nominal rates and inflation, have ranged between 0% and 1% for nearly a decade, well below the long-term average of 2.5%.

Since the beginning of the year, the S&P 500 Index is up 9.4%, but over 30% of that gain is concentrated in 5 stocks: Alphabet, Amazon, Apple, Facebook, and Microsoft. These so-called “Fab 5” technology stocks had seemed invincible, yet, on Friday, June 9th and the following Monday, these stocks dropped between 3% and 6%. Although they have stabilized since, when this momentum trade changes, the correction could be significant.

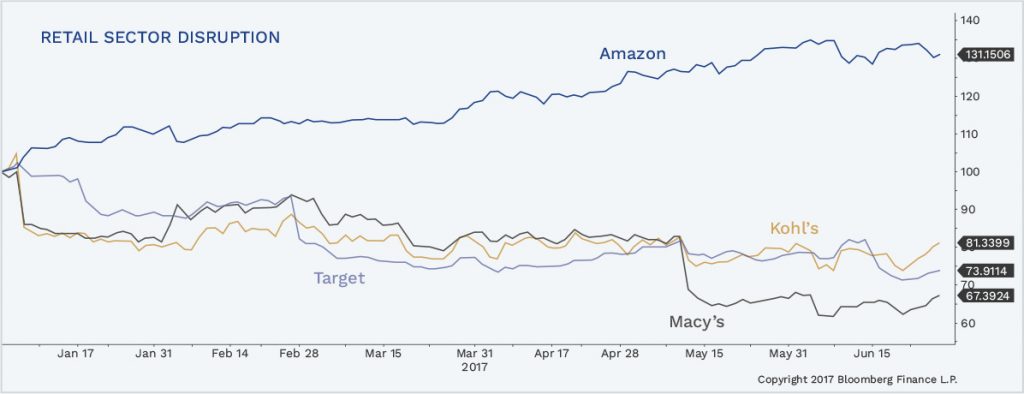

The pace of change in business is accelerating. For example, in the retail sector, Amazon appears to be taking over the world. Traditional middlemarket retailing’s existence is threatened by this accelerating change. Year to date, Macy’s shares are down 27%, Target shares are down 22%, and Kohl’s shares are down 20%. Meanwhile, Amazon shares are up 35%.

The stock market is inexorably rising while Republican intra-party divisiveness imperils the Trump agenda. This is reminiscent of the market’s behavior during the 2nd Clinton administration. Bill Clinton’s impeachment ran from late 1998 to early 1999, during which time the market continued climbing into “overvalued” territory, reaching a P/E of 33x. By comparison, today’s market P/E is one-third lower, at 22x.

We often mention price-to-earnings ratios as a stock market metric. Higher P/E ratios mean the market is more expensive. But how do P/Es relate to bond yields? If you invert the P/E, it becomes earnings as a percent of the market value (E/P). This earnings yield is the sum of three factors: Inflation + real bond return + the equity risk premium (ERP). The last factor is the amount of extra return an investor demands for taking the greater risk inherent in buying a share of common stock. In 1999, the market P/E was 33x, or an earnings yield of 3%. With inflation running at about 2%, this implied no real return and a 1% ERP.

The “normal” level of these variables is considered to be “2.5% times 3”: inflation of 2.5%, plus the real return at the 50-year average of 2.5%, plus the equity risk premium of 2.5%, giving a total of 7.5% earnings yield. This equates to a P/E of (1/.075), or 13.3x. Today, the market is trading at a P/E of 22x. With inflation of 1.5%, real bond return of 0% and a “normal” ERP of 2.5%, we would have an earnings yield of 4% which is equal to a P/E ratio of 25x. We acknowledge that this seems like mind-numbing math, but the bottom line is that the market is not a bargain, particularly if real bond return or inflation rise back to normal levels. However, as we learned in the late 1990s, overvaluation can persist for a long time. Eventually, valuation matters.

First quarter economic growth was weaker than expected at 2.0%, but unemployment dropped below 5%, giving the Fed room to continue inching rates higher. The Janet Yellen-led Fed moved on June 14th for the fourth time since December 2015 to increase the Federal funds rate to a range of 1-1.25%. Some speculate that the Fed is raising rates so that it can give itself room to cut in the future, should economic growth weaken. Furthermore, the Fed is deliberating how long it will take to unwind the post-crisis quantitative easing (QE) additions to the balance sheet. John Williams, the San Francisco Fed President, has stated he thinks it will take 5 years.

Politics has become synonymous with conflict. There seems to be no room for compromise. The Senate invoked the “nuclear option” to approve Neil Gorsuch as a Supreme Court justice. Now it only takes a simple majority to approve justices. Meanwhile, the Trump administration still has many vacant staff positions and is bogged down with media scrutiny and the politics of special investigations. The global phenomenon of rising populism and nationalism abated, at least temporarily, with Macron defeating Le Pen in the French election. German-French solidarity contrasts with the disunity in the UK. British Prime Minister Theresa May called for snap elections on June 8, but this backfired and her party lost the majority. This calls into question her long-term viability as Prime Minister.

As we learned in the late 1990s, overvaluation can persist for a long time. Eventually, valuation matters.

Our economy is chugging along at a slow pace, extending our weak and long recovery from the 2008 financial crisis. The media highlights nationalism, populism, anti-establishment forces, terror fears, and trade protectionism, but our bond and equity markets have been relatively immune to these fears. Markets react, people buy the dip, and we move on. Political risk does not seem to matter to earnings or the real economy. We worry, “are we being lulled into something?” But as there are no signs of irrational exuberance or euphoria, we are staying fully invested, although now is the time to be more vigilant.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.