Nelson Capital Management

2016 has gotten off to a rather ugly start. Five of the last eight trading days have produced declines of 200 to 400 points on the Dow Jones Industrial Average. The three up days were rather meek and the total decline since December 31 is nearing 1,300 points.

Forbes reports this to be the worst start to the year since the 1930s. On top of this there are several prognosticators spouting extreme gloom and doom. Yesterday, January 12th, Andrew Roberts (no relation to Brian Roberts) an economist at the Royal Bank of Scotland, warned of a “cataclysmic year” where stocks could fall up to 20% and oil could drop to $16 a barrel. His advice is to “Sell everything except for high quality bonds.”

Forbes reports this to be the worst start to the year since the 1930s. On top of this there are several prognosticators spouting extreme gloom and doom. Yesterday, January 12th, Andrew Roberts (no relation to Brian Roberts) an economist at the Royal Bank of Scotland, warned of a “cataclysmic year” where stocks could fall up to 20% and oil could drop to $16 a barrel. His advice is to “Sell everything except for high quality bonds.”

“The world is in trouble. The baton of growth pre-credit crunch was in the western world, and passed to Asia post-credit crunch..…this has been a debt-fueled build up. We have come to the end of the willingness to build up such debt, especially as demand factors start to act against this buildup.”

The debt issue is not new news. We showed in our fall presentation the statistics from 2014 on the buildup of corporate and consumer debt from 2000 to 2007 and how this has eased off in these two segments only to be replaced by governmental debt, especially in emerging markets over 2007 to 2014. So why bang the drum so loudly now?

Throughout the history of Wall Street there are numerous examples of individuals who once made a big hairy audacious forecast and got it right. Joe Granville, Elaine Garzarelli, Meredith Whitney are a few examples. We have yet to find the example of a prognosticator who made big call correctly twice in a row. Remember in this “American Idol” world we live in, if you make yourself a celebrity by saying something like this and you actually get it right there are riches to be gained. If you don’t get it right then you fade into oblivion with nothing ventured and nothing lost.

The media and Mr. Roberts continue to report the underlying problem is the weakness of the Chinese economy and lower oil prices. We think the Wall Street Journal correctly reports that “these are convenient excuses”. Lower oil prices hurt the energy sector but are actually stimulative to the overall economy. Emerging markets are 9% of the MSCI world index and less than 3% of our portfolios. Why are we letting this tail wag the dog?

The US economy is showing real signs of strength. The December Employment reports showed the biggest gains in non-farm payrolls since 2007 with 292,000 new jobs in the month, nearly 50% more than expected and a substantial revision to the November report from the initial 211,000 estimate up to 252,000 new jobs. Further, average hourly earnings are growing at 2.5% which is substantially more than current inflation.

The weakness in the price of oil benefits consumers and helps to restrain inflation. This should give the Federal Reserve cause to postpone further increases in interest rates. Indeed, since the Fed action on December 16th, which was the first move up since 2007, the rate on the 10 year US Treasury note has declined from 2.3% to 2.1%.

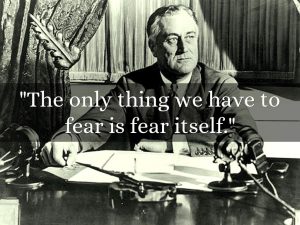

Fear mongering can easily take this market down further, and when the commotion dies down fundamentals will bring it back.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.