Nelson Capital Management

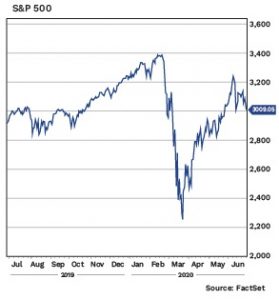

The S&P 500 hit a bottom of 2,192 on March 23, down 35% from its February 19th high. Much of this downturn was recovered in the second quarter, with the S&P rising to 3,100, finishing the quarter down about 3% from the beginning of the year. Positive (albeit early) data from treatment and vaccine trials as well as massive monetary and fiscal stimulus were the primary reasons behind the market’s quick recovery. As states have begun allowing businesses to reopen, incremental data has signaled better-than expected demand. Technology and healthcare stocks led the way higher at the beginning of the recovery, while more cyclical industries like finance and energy began to participate in the rally later in the quarter. Market commentators have highlighted FOMO (fear of missing out) and TINA (there is no alternative) as key forces driving stocks higher.

The booming stock market recovery belies the barrage of poor economic data. After several years of healthy job growth of around 200,000 per month, the U.S. lost over 21.5 million jobs in March and April, bringing the unemployment rate from 3.5% in February to nearly 15% in April. Year-over-year GDP growth dropped from 2.3% at the end of 2019 to 0.2% at the end of March. Abysmal retail sales numbers have notched new record declines during the quarter. Manufacturing data is as bad as it was during the 2008 Financial Crisis. Many companies have reduced their earnings expectations for the remainder of the year and around half of the companies in the S&P 500 have withdrawn their 2020 guidance completely. And yet, the market races higher.

The booming stock market recovery belies the barrage of poor economic data. After several years of healthy job growth of around 200,000 per month, the U.S. lost over 21.5 million jobs in March and April, bringing the unemployment rate from 3.5% in February to nearly 15% in April. Year-over-year GDP growth dropped from 2.3% at the end of 2019 to 0.2% at the end of March. Abysmal retail sales numbers have notched new record declines during the quarter. Manufacturing data is as bad as it was during the 2008 Financial Crisis. Many companies have reduced their earnings expectations for the remainder of the year and around half of the companies in the S&P 500 have withdrawn their 2020 guidance completely. And yet, the market races higher.

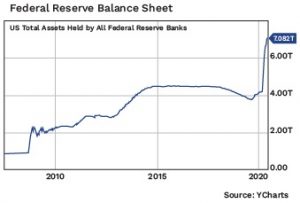

In the first 12 weeks after broad shutdowns began, the Federal Reserve added $3 trillion to its balance sheet, bringing the total to just under $7.2 trillion, an increase of more than 70%. Fiscal stimulus including the CARES Act passed by Congress and signed by President Trump added another $2.44 trillion of stimulus for individuals and businesses. The U.S. government debt-to-GDP ratio is expected to reach 131% this year, up from 109% in 2019 and higher than the debt burden seen after World War II.

In the near term, we believe that at some point the economy and the market must relink. Whether this means a rapid economic recovery or a drop in the market, only time will tell. As a result, we think now is the time to be cautious.

The firehose of stimulus from the Fed has caused money supply to skyrocket while the velocity of money, or the rate at which money is exchanged, has plummeted. In other words, there is a lot more money in the banks, but no one is spending it. Stimulus checks from the government appear to have been stashed away in savings accounts to prepare for troubled times ahead. The personal savings rate reached an all-time high of 33%, spiking from under 10% prior to the pandemic.

The firehose of stimulus from the Fed has caused money supply to skyrocket while the velocity of money, or the rate at which money is exchanged, has plummeted. In other words, there is a lot more money in the banks, but no one is spending it. Stimulus checks from the government appear to have been stashed away in savings accounts to prepare for troubled times ahead. The personal savings rate reached an all-time high of 33%, spiking from under 10% prior to the pandemic.

The pandemic is likely to send the U.S. into a recession. This changes the election outlook substantially, and is reflected in current polls.

The dramatic recovery has brought valuations roaring higher, especially with most companies experiencing a severe cut to earnings. We generally look at forward price to earnings (P/E) ratios, using projected earnings, but the withdrawal of guidance from most companies makes the forward “E” very unreliable.

The (backward-looking) trailing 12-month P/E ratio of the S&P500 has surged from 15x on March 23 to over 22x. We have also witnessed a few signs of speculative excess both in the options market and in the large wave of retail stock buying in the last few months. Furthermore, even though demand trends and economic data have been better than feared, they are still not favorable.

The (backward-looking) trailing 12-month P/E ratio of the S&P500 has surged from 15x on March 23 to over 22x. We have also witnessed a few signs of speculative excess both in the options market and in the large wave of retail stock buying in the last few months. Furthermore, even though demand trends and economic data have been better than feared, they are still not favorable.

We are looking to invest in companies and sectors where significant supply and demand disruptions did not occur due to coronavirus. We are also trying to parse which consumer behaviors will snap back and which have changed more permanently. Longer term, we are most concerned about how the fiscal and monetary stimulus gets unwound, although that impact could be years into the future. In the near term, we believe that at some point the economy and the market must relink. Whether this means a rapid economic recovery or a drop in the market, only time will tell. As a result, we think now is the time to be cautious.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.