Nelson Capital Management

The global selloff in equity markets put enormous pressure on the U.S. bond market in the month of March, raising concerns about the safety and liquidity of fixed income. As panic abated toward end of the quarter, credit markets rebounded and some normalcy returned to trading.

In mid-March, investors sold bonds and pulled cash from bond funds of all types at a record pace, prompting a vicious cycle of selling. Disruptions were felt in the U.S. Treasury market, which is typically immune to liquidity constraints. U.S. Treasury bill yields traded below zero as investors exited longer and less liquid bonds and fled to the safety of bills. At the end of the quarter, the 3-month Treasury bill and 10-year Treasury yielded 0.02% and 0.68%, respectively.

In mid-March, investors sold bonds and pulled cash from bond funds of all types at a record pace, prompting a vicious cycle of selling. Disruptions were felt in the U.S. Treasury market, which is typically immune to liquidity constraints. U.S. Treasury bill yields traded below zero as investors exited longer and less liquid bonds and fled to the safety of bills. At the end of the quarter, the 3-month Treasury bill and 10-year Treasury yielded 0.02% and 0.68%, respectively.

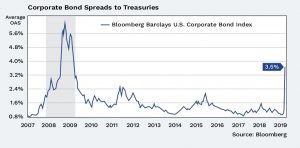

The corporate bond market came to a standstill as investors all tried to rush for the exits at the same time. Many investment grade and junk-rated debt offerings stopped trading. The spread (difference) between U.S. Treasury yields and investment grade bond yields widened from less than 1 percent before the COVID-19 crisis to over 3%. Junk bond spreads spiked to over 9%. Potential buyers stayed away as the market contemplated which companies would survive and which might go bankrupt.

Municipal bonds declined in value as cities and states closed nonessential services. The risk of an economic recession and the financial strain placed on local governments due to a drop in tax revenue had bondholders concerned.

The disruptions have prompted a series of extraordinary Federal Reserve interventions to keep capital flowing and to calm the markets. The Fed has lowered its benchmark target rate to zero, eased regulatory requirements for some banks, opened up new lending facilities and indicated it would buy bonds in unlimited quantities. In its March 23 announcement, the Fed established three new lending facilities to provide up to $300 billion of liquidity by purchasing corporate bonds, a wider range of municipal bonds and securities tied to such debt as auto and real estate loans. With the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Friday March 27, Congress approved an additional $454 billion for the Fed to lend. By providing the Treasury Department with a sizable pot of money, Congress has given the central bank more flexibility to ramp up lending and absorb initial losses.

The disruptions have prompted a series of extraordinary Federal Reserve interventions to keep capital flowing and to calm the markets. The Fed has lowered its benchmark target rate to zero, eased regulatory requirements for some banks, opened up new lending facilities and indicated it would buy bonds in unlimited quantities. In its March 23 announcement, the Fed established three new lending facilities to provide up to $300 billion of liquidity by purchasing corporate bonds, a wider range of municipal bonds and securities tied to such debt as auto and real estate loans. With the passage of the Coronavirus Aid, Relief, and Economic Security (CARES) Act on Friday March 27, Congress approved an additional $454 billion for the Fed to lend. By providing the Treasury Department with a sizable pot of money, Congress has given the central bank more flexibility to ramp up lending and absorb initial losses.

In response to the liquidity constraints, we have taken steps to ensure our safe investments are secure for what is currently an unknown period of market disruption. Our focus has always been to invest in high-quality investment grade bonds and not chase higher yields by buying lower quality debt. We will continue to monitor the fixed income markets closely as we move more money into cash and U.S. Treasuries. The good news is that even as U.S. government debt grows to levels not seen since World War II, global demand for U.S. Treasuries remains strong.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.