Nelson Capital Management

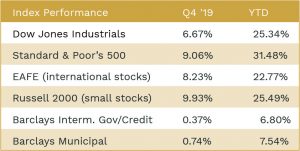

Global equity markets had a surprisingly positive fourth quarter, with most markets up about 8% to new all-time highs. Stock prices climbed the proverbial wall of worry, ignoring tariffs, impeachment, Brexit, slowing manufacturing data, a brief August yield curve inversion, and a controversial resumption of quantitative easing.

President Donald Trump continues to use tariffs and the threat of tariffs as a negotiation tactic with all of our trading partners, especially China. The tariffs have depressed economic growth in the U.S. but the impact has been more severe on the Chinese economy. Continued market optimism for a trade agreement was the main reason for the stock markets’ rise this quarter. On December 13, President Trump tweeted that the U.S. and China “will begin negotiations on the phase two deal immediately, rather than waiting until after the 2020 election.” Essentially, this was only an agreement to negotiate, but it was enough for Trump to postpone the tariff increases that were set to go into effect on December 15.

Recent monetary policy changes by the Federal Reserve have created a controversy. On September 16, the day that third quarter tax estimate payments hit the banking system, the fed funds rate spiked from 2% to more than 10% overnight. The Fed responded by implementing repurchase operations (repo) for the first time since the 2008-2009 financial crisis. Good old-fashioned repos look to some like quantitative easing (QE).

In late 2008, with interest rates at 0% and the economy still falling, the Fed, under Ben Bernanke, implemented a program to expand the Fed’s balance sheet extensively. When the Fed buys securities, it is essentially printing money electronically. With repos, that money comes back out of circulation in as short as a day or a month, depending on the maturity of the T-bills the Fed is buying. With QE, the Fed is buying long-term securities so that money remains in the economy for a much longer period of time.

From 2008 to 2015, in three steps, the Fed increased its securities holding from $900 Billion to $4.5 trillion. During this time (and continuing today), other central banks (European Central Bank, Bank of Japan, Bank of England, etc.) were also printing money in the same way by buying long-term bonds. Over the last decade, the amount of global liquidity has increased four-fold, from $4 trillion to $16 trillion dollars’ worth. The consequence of this created a shortage of bonds and an excess of cash so extreme that the yields in foreign bond markets dropped below 0%. By August 30 of 2019, the total dollar value of worldwide negative-yielding debt reached $17 trillion. With 30% of global sovereign debt yielding less than 0%, U.S. Treasury bonds yielding over 2% attracted so much demand that rates on the 10-year note fell nearly in half from 3.22% on 10/31/18 to below 1.52% on 9/30/19. In late August, this caused an inversion in the yield curve, with the yield on the 2-year note below that of the 10-year. This lasted about 5 days and was a miniscule 5 basis points (0.05%). Traditionally, an inverted curve is a leading indicator of a coming recession. But in every instance previously, a curve inversion has been caused by the Fed increasing short rates. This time was truly different as the inversion was caused by falling long bond rates.

In 2014, the amount of global negative-yielding debt was near $0. Between 2015 and 2018, the total averaged $8 trillion. After peaking in August at $17 trillion, the total declined 35% in the fourth quarter to about $11 trillion. There appears to be impetus for a cessation of QE globally. If that is true, then we will stop worrying about a potential currency crisis such the one that occurred in post-WW1 Germany after they printed massive amounts of money to pay for the war and reparations.

On October 30, the Federal Reserve announced a cut in the target for the Federal Funds rate for a third time, to a range of 1.50 to 1.75%. These cuts reversed all of the increases they made in 2018. The Fed has since announced that they are “on hold.” It is very unlikely they will do anything further until after the November 2020 election.

If an inverted curve is the leading indicator of a coming recession, it will be confirmed by the deceleration in year-over-year job growth, a coincidental indicator. The labor market continues to maintain moderate strength, with 266k new jobs created in November. Therefore, it looks unlikely that the economy will turn down anytime soon.

If an inverted curve is the leading indicator of a coming recession, it will be confirmed by the deceleration in year-over-year job growth, a coincidental indicator. The labor market continues to maintain moderate strength, with 266k new jobs created in November. Therefore, it looks unlikely that the economy will turn down anytime soon.

Running up to the election, clients from both sides of the political divide call asking if we think politics will cause a market decline. The Economist, in “Figuring out the 2020 Race,” correctly points out that the economy has more impact on politics than vice versa. When GDP is rising during an election year, the incumbent president running for re-election has not lost since 1892.

On December 19, the House of Representatives voted on party lines to impeach President Trump. Since there is a Republican majority in the Senate, it is very unlikely that the president will be convicted. Consequently, we are likely to have President Trump through 2024.

In the management of our client portfolios, we put aside the dramas of impeachment, trade wars, and monetary policy controversy. Instead, we focus on whether one should desire to buy a 2% IBM note or the stock yielding 5%—obviously, we choose the latter. But remembering that we are in the longest running expansion ever, it makes sense to focus on undervalued stocks with higher dividend yields. Our pivot to value continues.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.