Nelson Capital Management

The optimists among us thought 2021 might be the year everything went back to normal. For a short time in the spring, with vaccination momentum underway, it seemed like we were headed that direction. However, the remainder of the year brought Delta and Omicron, snarled supply chains, and escalating inflation concerns. Despite these complications, the S&P 500 rose 27%, the third year in a row of double-digit returns, notching 70 new record highs throughout 2021. Corporate profits rebounded 68% in 2021 after falling 22% the year before. Companies are passing on price increases to customers faster than costs are rising, protecting margins and insulating profits, but also likely fueling the flames of inflation.

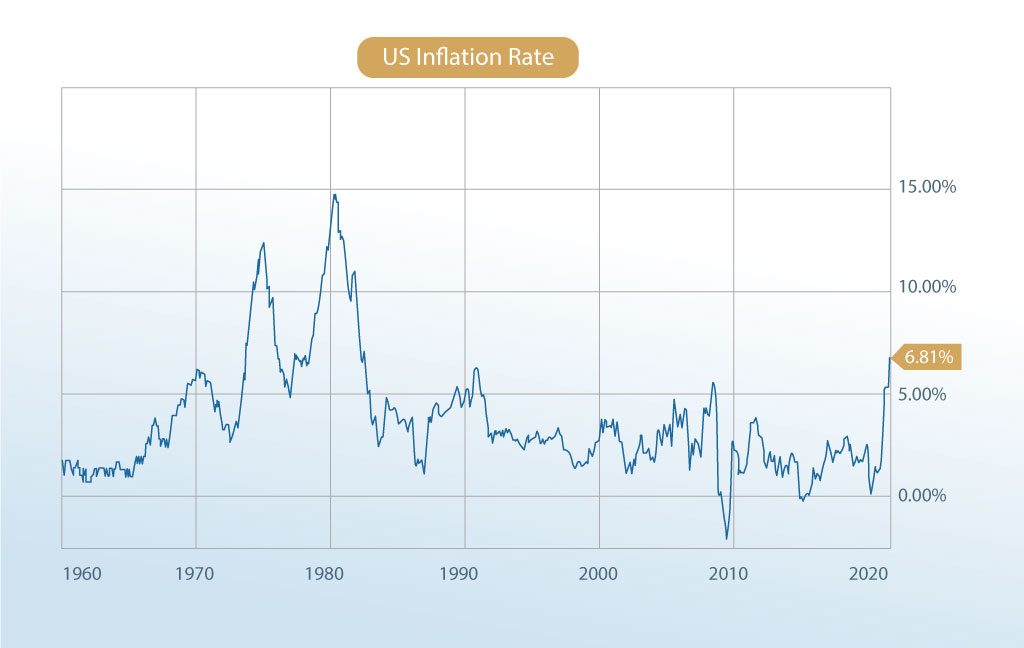

Higher energy prices, rising food and raw materials costs, record high transport costs, and a very tight labor market have helped push the Consumer Price Index (CPI) higher. The CPI rose 6.8% year-over-year in November, the fastest increase in about 30 years. The largest component of CPI is “Owners’ Equivalent Rent,” a survey-based shelter price measure that asks homeowners what they think their house might rent for monthly, furnished and without utilities. This data is collected every six months, and arguably might understate the real cost of shelter (and perhaps the entire index), given the more dramatic increases in the housing and rental markets. Regardless, we no longer need to debate whether inflation is on the horizon. High inflation is here now. Even the Federal Reserve recently ditched the term “transitory” with regard to inflationary pressures, and pivoted toward a more restrictive stance. At its most recent meeting, the Fed indicated that it would taper its bond-buying program more quickly and sooner than previously stated. The Fed also announced that it would begin tightening in 2022, with three rate hikes expected this year.

Higher energy prices, rising food and raw materials costs, record high transport costs, and a very tight labor market have helped push the Consumer Price Index (CPI) higher. The CPI rose 6.8% year-over-year in November, the fastest increase in about 30 years. The largest component of CPI is “Owners’ Equivalent Rent,” a survey-based shelter price measure that asks homeowners what they think their house might rent for monthly, furnished and without utilities. This data is collected every six months, and arguably might understate the real cost of shelter (and perhaps the entire index), given the more dramatic increases in the housing and rental markets. Regardless, we no longer need to debate whether inflation is on the horizon. High inflation is here now. Even the Federal Reserve recently ditched the term “transitory” with regard to inflationary pressures, and pivoted toward a more restrictive stance. At its most recent meeting, the Fed indicated that it would taper its bond-buying program more quickly and sooner than previously stated. The Fed also announced that it would begin tightening in 2022, with three rate hikes expected this year.

Rising inflation also threw a monkey wrench into the Democrats’ plans for additional fiscal stimulus. Despite controlling both houses of Congress, the party reached an impasse on a social infrastructure spending bill. Senator Joe Manchin (D.-W.Va) said he could not vote for the Build Back Better bill, expressing concern over the impact it would have on inflation and the national debt. Though negotiations are reportedly not officially dead, the Democrats certainly lost momentum and seemed to end the year in disarray. Though it is possible we could see a revised version of the bill, focus will soon shift to the midterm elections, and the window for additional stimulus will close.

Within our equity portfolio, we are looking to invest in more value-oriented companies. If the Fed follows through on its plan to tighten its monetary policy and raise interest rates, we believe that current high valuations will face a reckoning.

Despite the Fed’s pivot and dashed hopes of further fiscal stimulus, the party in the equity market continues. Omicron remains an overhang, but given the milder symptoms and lack of appetite for further lockdowns, it has largely been dismissed by investors. We are seeing signs of euphoria that suggest caution. 2021 was a record year for IPOs: 1,057 offerings were brought to market, far exceeding the 473 seen during the peak of the dot-com boom in 1999. The forward price-to-earnings ratio of the S&P 500 is currently 21x, more than one standard deviation above the 25-year average level of 16.8x. Valuations are even more extreme in certain corners of the market (electric vehicle companies), and in others (“memecoins” and meme stocks), valuation seems completely disconnected from reality. Narrowing market breadth also creates reason for caution. The S&P 500 is more concentrated now than it has ever been, with the top ten stocks making up about 31% of the entire index. The market cap of Apple (tkr: AAPL) recently crossed the $3 trillion threshold. Just five stocks out of the 500 in the S&P 500—Microsoft (tkr: MSFT), Apple, Alphabet (tkr: GOOG), Nvidia (tkr: NVDA), and Tesla (tkr: TSLA)—are responsible for about one-third of the total gain this year.

The bond market has little to offer. Global bond yields remain low, and real rates of return (calculated by taking nominal bond yields and subtracting inflation rates), are deeply negative and at 60-year lows. The short end of the curve has risen slightly, but the long end of the curve is still very low, with the 10-year Treasury yield range-bound around 1.50%. The bond market seems to believe that high inflation is not here to stay. Chairman Jerome Powell was selected for another four-year term, providing consistency at the central bank. Perhaps the bond market believes that the Fed will be in a position to control inflation and bring it back down to its target. The TINA (“there is no alternative”) phenomenon remains in place, and helps explain why the equity markets continue to race higher.

We are not recommending clients make substantial changes to asset allocation, particularly given the negative real yields and the impact inflation has on the bond market. We recognize that “euphoria” can go on longer than many expect, and so we continue to stay disciplined in our strategy of periodic rebalancing to model targets. Within our equity portfolio, we are looking to invest in more value-oriented companies. If the Fed follows through on its plan to tighten its monetary policy and raise interest rates, we believe that current high valuations will face a reckoning.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.