Nelson Capital Management

After most businesses fully reopened early in the summer, July brought the rise of the Delta variant of COVID-19, sparking new restrictions and threatening the nascent reopening momentum. Companies began reporting worsening supply chain challenges, which many warned would weigh on margins in coming quarters. The $3.5 trillion spending bill proposed by Democrats provided hopes of further fiscal stimulus tailwinds, but also threatened to bring new tax hikes, including an increase in the corporate tax rate that could lead to a haircut on company earnings. The equity markets seemed to brush most of these fears off, instead focusing on the continued policy support from the Federal Reserve and U.S. government and the longstanding resilience of the “buy-the-dip” mantra. Furthermore, with bond yields remaining near zero and negative real rates of return, the TINA phenomenon (“there is no alternative”) also lent support to equity markets. Meanwhile, valuations remained stretched, though off their highs, with the S&P 500 trading at over 21 times forward earnings.

September’s slightly cooler weather ushered in a chill to the markets. The final month of the third quarter saw the S&P 500 decline just under 5%. Most of the overhangs cited in the headlines were old news (Delta variant cases, anticipated higher taxes, supply chain pressures, stretched valuations) although some were new. The path to increasing the debt ceiling became complicated and Democrats faced divisions within their party over the size and scope of their “human infrastructure” spending bill. Furthermore, turmoil in China rocked the markets as Evergrande, the country’s second-largest real estate developer, defaulted on its liabilities, prompting fears that this might lead to a broader financial crisis. Meanwhile, Chinese officials tightened regulations on industries such as technology, gaming, private tutoring and gambling, and cracked down on the cryptocurrency market, aiming to consolidate government control. Reports also discussed Chinese government efforts to curb energy consumption and reduce carbon emissions, leading to halted production at factories, further worsening supply chain issues.

The longer these “transitory” pressures take to unwind, the more concerned we are that inflation will stick around long enough to seep into the psychology of consumers.

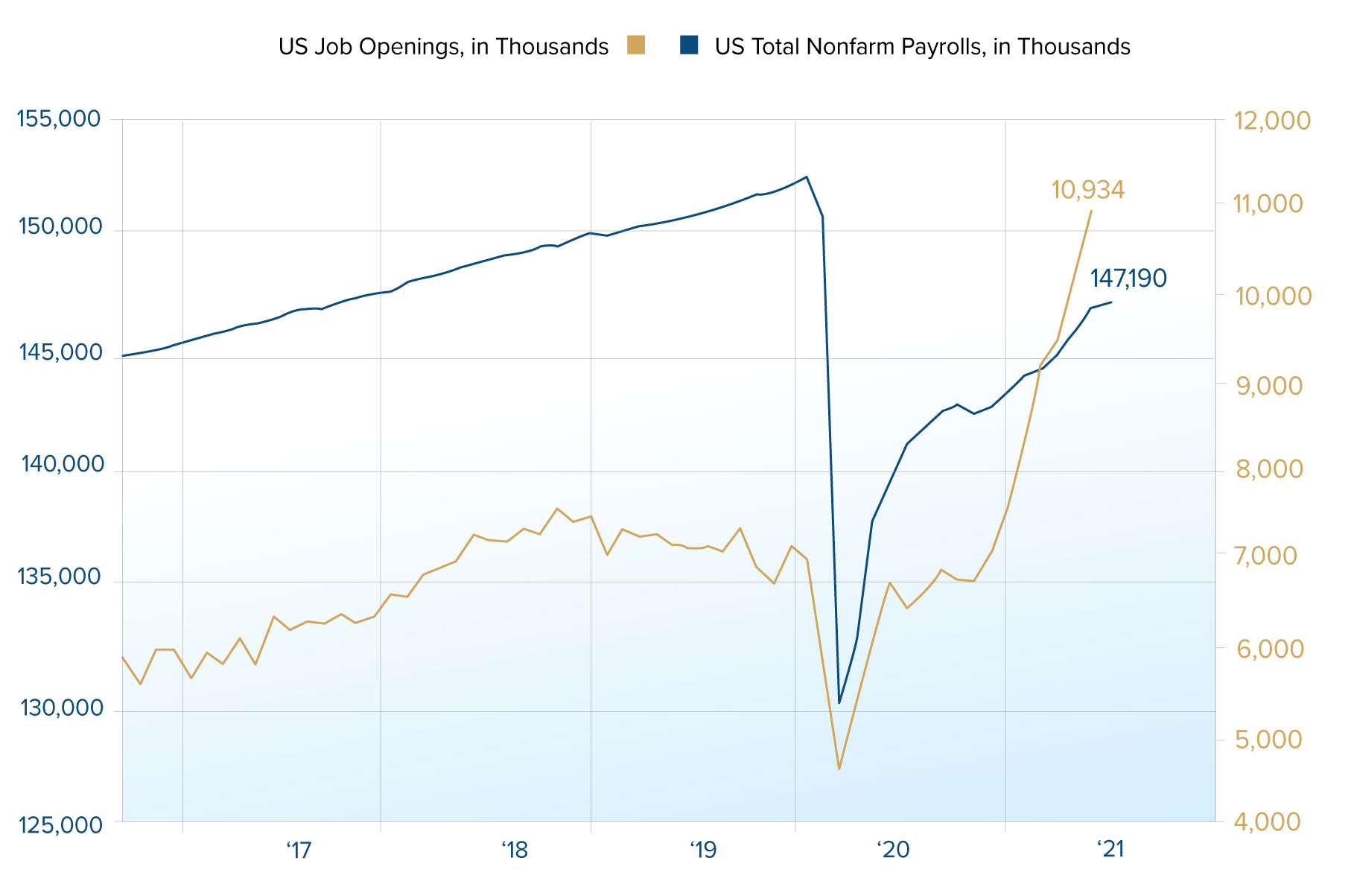

Looking past the market movements and headlines to the underlying data, the U.S. economy continues to recover from the pandemic, although the Delta variant has made the timing and path of the recovery less certain. The labor market, which generally indicates future health of the economy, presents a puzzling conundrum: despite recovering from the deepest job losses of 2020, the U.S. is still down 5 million jobs relative to pre-pandemic levels. Meanwhile, companies in every industry are reporting difficulty finding employees and job openings are at a record high of nearly 11 million, compared to about 7 million in 2019. Some believe that the September expiration of unemployment benefits will bring people back into the labor force, but we have not seen evidence of this happening, even in states where benefits were discontinued months ago. Perhaps children returning to in-person school will bring some back into the labor market. This tight job market is already leading to increasing wages, which generally stimulates consumer spending and economic growth but could also contribute to inflationary pressures that have started stacking up.

Many economists and Federal Reserve officials maintain that inflationary pressures are “transitory.” Those who subscribe to this view believe that supply chain snarls and raw material shortages will soon resolve, bringing supply, demand, and prices back in line with more normal, muted price increase trajectories. However, the longer these “transitory” pressures take to unwind, the more concerned we are that inflation will stick around long enough to seep into the psychology of consumers. Shoppers concerned about price increases tomorrow will tend to buy today, especially those who have higher wages and stimulus checks in their accounts. Furthermore, the Federal Reserve’s monetary stimulus measures have increased U.S. money supply by over 25% in one year, leading to concerns that we may have too much money chasing too few goods. Commodity prices have cooled off since hitting highs in mid-May but some, including the price of oil, continue to march higher. Shelter, which makes up about 40% of the Consumer Price Index (CPI) measure of inflation, is still showing muted gains, but strength in the rental and housing markets hint that this may increase in coming months. If inflation sustains levels of greater than 2.5%, it will mark a change from the 30-year downtrend in price increases. Some have attributed the inflation downtrend to technological advancements, while others have attributed it to increased globalization. Technological advancements have certainly continued (or even accelerated) during the last 18 months, although the pandemic and remaining Trump-era tariffs could lead to a reversal of globalization and an increase in domestic manufacturing, which could be inflationary.

We are watching closely for signs of supply chain issues and labor market tightness easing. At this point, we do not believe that anyone can predict whether these issues are transitory or not. However if these problems persist, we could be headed toward an inflation rate that exceeds 2.5%. While inflation at this level might not impact the market adversely, higher inflation would lead to increased interest rates that would challenge the current equity market valuations. We are not recommending a change in asset allocation or strategy at this time, but will closely monitor the trajectory of longer-term inflation, as we believe this is currently the greatest risk to markets.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.