Nelson Capital Management

Summer is here, vaccinations have rolled out and most Americans are back to pre-pandemic activities. Households have racked up savings and are now ready to unleash excess spending, particularly on services and experiences that have been off-limits for over a year. $5 trillion worth of stimulus has been passed already, and Congress is putting together yet another stimulus bill aimed at infrastructure. Last quarter, we asked whether inflation was on the horizon. Many are now asking whether it is already here.

Pent-up consumer demand has so far been met with supply shortages, especially labor supply. Companies in every industry are reporting difficulty hiring despite increasing bonuses, salaries, and incentives. Goods producers have also reported higher input costs, with elevated raw materials and shipping prices. Anyone looking for a new home will report plenty of inflation in the white-hot housing market. Anyone remodeling a home will report runaway costs of raw materials and labor shortages. Most survey-based inflation data reflect consumer opinions that higher prices have already arrived. However, other data points tell a different story.

Pent-up consumer demand has so far been met with supply shortages, especially labor supply. Companies in every industry are reporting difficulty hiring despite increasing bonuses, salaries, and incentives. Goods producers have also reported higher input costs, with elevated raw materials and shipping prices. Anyone looking for a new home will report plenty of inflation in the white-hot housing market. Anyone remodeling a home will report runaway costs of raw materials and labor shortages. Most survey-based inflation data reflect consumer opinions that higher prices have already arrived. However, other data points tell a different story.

The “base effects” of 2020, which witnessed artificially low demand and prices, has clouded the year-over-year calculations. Headline Consumer Price Index (CPI) data reflected a 5% increase in prices, the highest level in 13 years—but this was compared to May 2020, when the economy was frozen by the pandemic. Furthermore, the data has been skewed by a few volatile items. A scarcity of used cars (exacerbated by a shortage of semiconductors) caused used car prices to jump nearly 30% in May as rental car agencies were reopening and trying to increase inventory. The Cleveland Fed publishes a measure of inflation that excludes such volatile items. This “Median CPI” index was up only 2.1% in May, much lower than the 5% headline CPI increase.

After over a decade of low inflation, a few brushes with deflation, and a global pandemic, the Federal Reserve has said it will allow inflation to run hotter. The Fed had projected no rate hikes before 2023, leading some to fear that it was behind the curve. However, at its most recent meeting, the Fed moved up its forecast, predicting two rate hikes by the end of 2023 while maintaining its outlook that inflationary pressures are mostly transitory in nature. The bond market agrees with the Fed. Inflation expectations based on the pricing of Treasury inflation-protected securities (TIPS) are muted. Rates have also come back down, with the 10-year Treasury rate below 1.50%.

Is inflation heading higher? The answer can be “yes” without implying we are headed for runaway inflation.

If inflation trends back to 2%, it will be at the level the Fed has been trying to achieve for the last decade. The Fed has plenty of tools to rein inflation in, but the last 10 years tell us that no amount of rate cuts or quantitative easing can effectively drive inflation higher.

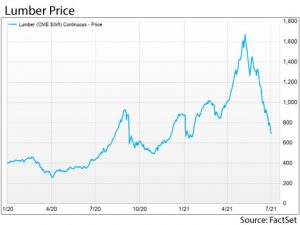

After a stunning rise in the commodities market, prices have generally pulled back. Lumber prices, though still higher than average, have declined more than 50% from the record high set on May 7th. Despite hiring difficulties reported by employers, the labor market has not fully recovered. The U.S. is still down over 7 million jobs since the pandemic began. We continue to track the velocity of money, which measures the turnover of money in the economy. We expect this to increase if inflation picks up. Thus far, it has not. We do not disregard the supply chain disruption and price spikes in various input costs, but these will likely smooth out as consumer wallet share shifts from goods to services as the economic reopening continues.

After a stunning rise in the commodities market, prices have generally pulled back. Lumber prices, though still higher than average, have declined more than 50% from the record high set on May 7th. Despite hiring difficulties reported by employers, the labor market has not fully recovered. The U.S. is still down over 7 million jobs since the pandemic began. We continue to track the velocity of money, which measures the turnover of money in the economy. We expect this to increase if inflation picks up. Thus far, it has not. We do not disregard the supply chain disruption and price spikes in various input costs, but these will likely smooth out as consumer wallet share shifts from goods to services as the economic reopening continues.

Meanwhile, the stock market continues to grind higher on elevated price-to-earnings multiple valuations. Our biggest concern is not that the massive monetary creation has created consumer price inflation, but rather that it has led to asset price inflation, particularly stocks and homes. Nevertheless, there are reasons to be optimistic about the equity market. Most companies successfully insulated their balance sheets over the last year and now have money to spend on capital expenditures. Pent-up consumer demand will likely translate into higher company earnings growth. We have tilted our equity exposure to relatively cheaper stocks that pay dividends and are more cyclical in nature. We also increased our exposure to international equities, which are at a multi-year valuation discount relative to U.S. stocks.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.