Nelson Capital Management

No matter who you ask, 2020 was a tumultuous year. It was a year that forced many of us to cancel plans, change habits, gain perspective, and learn never to take for granted long hugs with loved ones. 2020 was also a record breaking year, for worse and for better. The cost in human life was devastating. 2020 was the deadliest year in U.S. history, with 400,000 more deaths than in 2019, due primarily to the onset of COVID-19. On the other hand, we also witnessed the extraordinary speed of vaccine development, with two SARS-CoV-2 vaccine candidates brought to the U.S. market in a matter of months. The monetary and fiscal stimulus put into place by the Federal Reserve and by the U.S. government not only set new records, but also surpassed the post-Great Recession stimulus in both size and speed.

No matter who you ask, 2020 was a tumultuous year. It was a year that forced many of us to cancel plans, change habits, gain perspective, and learn never to take for granted long hugs with loved ones. 2020 was also a record breaking year, for worse and for better. The cost in human life was devastating. 2020 was the deadliest year in U.S. history, with 400,000 more deaths than in 2019, due primarily to the onset of COVID-19. On the other hand, we also witnessed the extraordinary speed of vaccine development, with two SARS-CoV-2 vaccine candidates brought to the U.S. market in a matter of months. The monetary and fiscal stimulus put into place by the Federal Reserve and by the U.S. government not only set new records, but also surpassed the post-Great Recession stimulus in both size and speed.

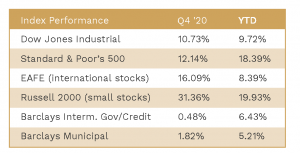

The S&P 500 index witnessed its fastest bear market on record followed by the quickest recovery in history. The “melt up” in stocks continued into December, despite near-daily new records set for numbers of cases, hospitalizations, and deaths from COVID. The index finished the year up over 18%, recovering all losses from earlier in the year. This rally has been powered by a combination of vaccine optimism, fiscal and monetary stimulus, the “fear of missing out” (FOMO) and “there is no alternative” (TINA) factors that have funneled investors into the equity market, better-than-feared corporate profits, and significant concentration of the index in companies that have benefited from stay-at-home, work/learn-from home trends.

The S&P 500 index witnessed its fastest bear market on record followed by the quickest recovery in history. The “melt up” in stocks continued into December, despite near-daily new records set for numbers of cases, hospitalizations, and deaths from COVID. The index finished the year up over 18%, recovering all losses from earlier in the year. This rally has been powered by a combination of vaccine optimism, fiscal and monetary stimulus, the “fear of missing out” (FOMO) and “there is no alternative” (TINA) factors that have funneled investors into the equity market, better-than-feared corporate profits, and significant concentration of the index in companies that have benefited from stay-at-home, work/learn-from home trends.

We see signs of froth everywhere. The S&P 500 is now trading at price-to-earnings (P/E) and price-to-sales (P/S) valuations that were last seen at the height of the dot-com bubble. The IPO market set records this year with $167.2 billion raised on U.S. exchanges–far exceeding the previous high of $107.9 billion set at the height of the dot-com boom in 1999. The average one-day price increase for newly minted public stocks was 40%. Bitcoin is now above $30,000, rising nearly 400% in 2020. Electric-car maker Tesla (tkr: TSLA) was added to the S&P 500 index in December, following a 700%+ stock price increase since January.

Meanwhile, economic data has underwhelmed. The labor market is still down about 10 million jobs since the start of the pandemic, and we are witnessing roughly 800,000 jobless claims being filed each week. The November jobs report was particularly disappointing, with just 245,000 jobs added—well below the 460,000 estimated number and much lower than the 610,000 added in October.

Meanwhile, economic data has underwhelmed. The labor market is still down about 10 million jobs since the start of the pandemic, and we are witnessing roughly 800,000 jobless claims being filed each week. The November jobs report was particularly disappointing, with just 245,000 jobs added—well below the 460,000 estimated number and much lower than the 610,000 added in October.

Furthermore, retail sales have begun to wane as the spike in case numbers across the country has dampened economic growth trends. The stock market appears to have completely delinked from the fundamental economic data that it traditionally cares about.

With euphoria seemingly all around us, it is difficult to avoid comparisons to the valuation bubble of the dot-com era. The question is: How close are we to the end? Are we in 1997 or 1999? Then-chairman of the Federal Reserve, Alan Greenspan, famously warned that equity markets were exhibiting “irrational exuberance” prior to the dot-com bubble bursting. However, Greenspan’s quote was from a speech made on December 5, 1996, more than three years prior to the tipping point at which the bubble burst.

If we are currently in another valuation bubble, what could be the tipping point that causes it to burst this time? In 2000, the Federal Reserve began increasing interest rates to combat rising inflation. In May of 2000, the Fed’s benchmark interest rate stood at 6.5%. By contrast, the current Federal Reserve has promised to keep rates at zero out to at least 2023, while also maintaining its stimulative asset purchase program. The Fed will likely be able to stick to this commitment given the lack of inflationary pressures in today’s environment. Current Fed chairman Jerome Powell commented recently that he does not consider equities to be overvalued on a risk/reward basis. Furthermore, the U.S. recently passed yet another coronavirus relief bill that will add about $900 billion worth of fiscal stimulus on top of the $2.44 trillion that has already been passed. With this stimulus and if we see a flawlessly executed vaccine rollout, it is possible we could see a dramatic earnings recovery that could help support current equity prices. A vaccine manufacturing delay or snafu, on the other hand, could easily lead to a stock market correction.

We remain disciplined in our strategy, seeking out investments that carry attractive valuations on a relative basis. But given the low-rate environment, low inflation and unprecedented stimulus, we think the markets may head further into euphoria.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Capital Management, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.