Nelson Capital Management

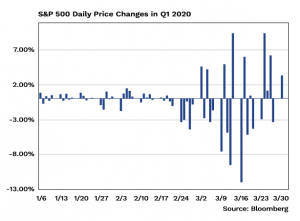

The coronavirus outbreak that has ravaged the globe has led to extreme volatility in nearly every market. The Dow Jones Industrial Average fell more than 20%, into bear market territory, in just 20 trading days. This was the fastest bear market plunge in history, exceeding the pace of declines seen during the Great Depression. Then, between March 23 and March 26, the Dow recovered over 20%, notching a technical bull market in just three days. The complete lack of reliable data has created an information vacuum, leading to even higher volatility than was seen during the depths of the financial crisis in 2008. Market-wide circuit breakers have been triggered multiple times alongside precipitous drops during trading sessions. Fortunately, stock and bond markets have remained fully operational and have weathered the hysteria without breaking liquidity.

We have said before that markets hate uncertainty, and right now that is all we have. Without wide- spread testing of 100% of all individuals in statistically representative geographies, no one can know for sure when this outbreak will come under control. From a health standpoint, it appears that a strict lockdown is needed to bring down the rate of infection. But of course, the longer and more restrictive the lockdown, the more severe the economic shock. At this point, both the health and economic impacts will be devastating. Without a timeline for the resolution of either, nobody can gauge just how devastating.

We have said before that markets hate uncertainty, and right now that is all we have. Without wide- spread testing of 100% of all individuals in statistically representative geographies, no one can know for sure when this outbreak will come under control. From a health standpoint, it appears that a strict lockdown is needed to bring down the rate of infection. But of course, the longer and more restrictive the lockdown, the more severe the economic shock. At this point, both the health and economic impacts will be devastating. Without a timeline for the resolution of either, nobody can gauge just how devastating.

The U.S. went from being a country with few cases to being the country with the largest number of cases within about two weeks. Although the federal government has implemented social distancing guidelines extending out to the end of April, most of the restrictions have been set up at the state level. In California, the shelter-in-place order began March 17, and early data indicate that these efforts have helped reduce the spread. On the other side of the spectrum, cases in New York continue to rise exponentially and there are signs that the health systems there are being overwhelmed.

Though we do not know how deep the economic scars will be, we are starting to gather a few data points. On March 26, 3.3 million Americans filed for unemployment. This was the largest number of claims ever, dwarfing the previous record set in 1982 by a factor of five. On April 2, another 6.6 million unemployment claims were filed, doubling the new record set one week before. The March jobs report from the labor department will be released on Friday, April 3rd. The current consensus estimate is for losses of 100,000 jobs, but the range of economists’ estimates is from a positive gain of 100,000 to a loss of 4 million. In other words, nobody has a clue.

Though we do not know how deep the economic scars will be, we are starting to gather a few data points. On March 26, 3.3 million Americans filed for unemployment. This was the largest number of claims ever, dwarfing the previous record set in 1982 by a factor of five. On April 2, another 6.6 million unemployment claims were filed, doubling the new record set one week before. The March jobs report from the labor department will be released on Friday, April 3rd. The current consensus estimate is for losses of 100,000 jobs, but the range of economists’ estimates is from a positive gain of 100,000 to a loss of 4 million. In other words, nobody has a clue.

We typically look at the forward price-to-earnings (P/E) ratio to get an idea of how expensive or cheap stocks are. Currently, no company or analyst has any idea what forward earnings will be, so the “E” in the equation is just a big question mark.

The Federal Reserve and the U.S. government have responded promptly, with a double-barreled shot of fiscal and monetary stimulus. The Fed quickly began buying securities, expanding its balance sheet from $4.2 trillion in assets at the beginning of March to $5.2 trillion, surpassing the prior post-financial crisis high of $4.5 trillion. On March 27, President Trump signed into law the $2.2 trillion coronavirus relief bill (Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020). While we think that this massive fiscal and monetary stimulus is likely necessary to help bridge the gap and relieve those hurt most, we are concerned about what an unwinding of this stimulus might look like down the road.

In the meantime, we continue to search for signs of when this pandemic might come under control. In China, where this all began, the severe two-month long lockdown ultimately appears to have been effective, as the country is slowly getting back to work now that it has seen multiple days with no new infections. But cases are still on the rise in both the U.S. and across Europe, and we may yet see outbreaks spike elsewhere.

We are missing both data and context with which to make decisions. We are hoping for the best, but preparing for the worst, as we want to be conservative rather than aggressive in our positioning. We do not recommend selling into this decline, but we took the recent 20% market increase as an opportunity to exit positions we feel are most vulnerable to further downside if the situation deteriorates. In our commentary last fall, we recommended that clients review asset allocation with us, and this exogenous market shock reminds us why we engage in that discipline.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.