Nelson Capital Management

The current economic expansion began in July of 2009. At 108 months long, it is the third-longest expansion in history, and it is more than twice as long as the postwar average of 47 months. Many are asking: should we anticipate this current bull market coming to an end? Although bull markets do not simply die of old age, in the a previous blog post, we identified three potential risks to the current bull market run: trade disruptions, overvaluation and the Fed tightening.

The current economic expansion began in July of 2009. At 108 months long, it is the third-longest expansion in history, and it is more than twice as long as the postwar average of 47 months. Many are asking: should we anticipate this current bull market coming to an end? Although bull markets do not simply die of old age, in the a previous blog post, we identified three potential risks to the current bull market run: trade disruptions, overvaluation and the Fed tightening.

Trade

Headlines detailing the latest Trump tariffs often cause jolts to daily market moves, contributing to higher near-term volatility. Most of the tough trade talk has been directed at China, although relations with many of our “friendly” trading partners have also become strained. Although this short-term volatility is uncomfortable, we do not think this will be what ultimately derails the economy. We believe that this trade talk is mostly posturing at this point, particularly in advance of trade negotiations.

Overvaluation

In late January, valuation was a concern. The S&P 500 saw a feverish run at the start of the year, rising over 7% in four weeks and hitting an all-time high on January 26th. At the peak, the forward-looking price-to-earnings (P/E) ratio of the S&P was more than 19 times. Since then, however, the index has declined by 4.55%. The initial shock to the market was due to a higher-than-expected wage growth number, which fueled speculation that inflation might be running out of control. The second jolt to the markets was caused by the first tariff announcement by the Trump administration. The market’s post-January decline, combined with substantial earnings growth fueled by the corporate tax cut, has reduced this forward P/E value to 16.1 times. This level is much closer to the S&P 500’s average valuation over the last 25 years. Therefore, at present, we do not think that overvaluation will be the cause for the end of this bull market. Instead, we believe that the market will continue to follow earnings in the near term, and that earnings will continue to grow, stimulated by the tax cuts.

Fed Tightening

Our principal concern is the Federal Reserve overtightening. The Fed sets its target rate based on signals it watches from jobs and inflation data. As unemployment has fallen and the economy has picked up, many industries have seen labor shortages. As long as company earnings remain on track, we believe that these shortages will continue. We are closely watching one particular piece of jobs data: the yearly change in total number of nonfarm jobs. Before each of the last three recessions, this number has dipped below 1%. The latest value was 1.62%.

Our principal concern is the Federal Reserve overtightening. The Fed sets its target rate based on signals it watches from jobs and inflation data. As unemployment has fallen and the economy has picked up, many industries have seen labor shortages. As long as company earnings remain on track, we believe that these shortages will continue. We are closely watching one particular piece of jobs data: the yearly change in total number of nonfarm jobs. Before each of the last three recessions, this number has dipped below 1%. The latest value was 1.62%.

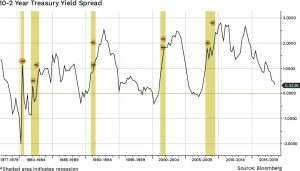

The Federal Funds Target Rate stands at 2% currently, and we expect two more increases this year, which would put the rate at 2.5% by year-end. The Fed is moving its rate up, following inflation, producing no change in real rates. Furthermore, although short-term rates have moved up with the Fed rate increases, longer-term rates are not reacting to the Fed’s actions. Since the Fed first began raising its target rate in December 2015, the two-year Treasury yield has moved from 0.93% to 2.53%. Meanwhile, the 10-year Treasury has only moved from 2.21% to 2.86%. Why? Longer-term U.S. Treasury bond yields have not risen because there is currently no yield anywhere outside the U.S. A United Kingdom 10-year government bond yields 1.28%, a German 10-year yields 0.30% and a Japanese 10-year yields a paltry 0.03%.

The Federal Funds Target Rate stands at 2% currently, and we expect two more increases this year, which would put the rate at 2.5% by year-end. The Fed is moving its rate up, following inflation, producing no change in real rates. Furthermore, although short-term rates have moved up with the Fed rate increases, longer-term rates are not reacting to the Fed’s actions. Since the Fed first began raising its target rate in December 2015, the two-year Treasury yield has moved from 0.93% to 2.53%. Meanwhile, the 10-year Treasury has only moved from 2.21% to 2.86%. Why? Longer-term U.S. Treasury bond yields have not risen because there is currently no yield anywhere outside the U.S. A United Kingdom 10-year government bond yields 1.28%, a German 10-year yields 0.30% and a Japanese 10-year yields a paltry 0.03%.

The Fed’s seven rate increases since 2015 have only affected the short end of the curve, causing the yield curve to flatten. Since 2011, the spread between the 10-year bond and 2-year bond has decreased from 2.89% to 0.33%. We are watching this spread extremely closely. This spread has turned negative as the yield curve has inverted ahead of every postwar recession.

The Fed’s seven rate increases since 2015 have only affected the short end of the curve, causing the yield curve to flatten. Since 2011, the spread between the 10-year bond and 2-year bond has decreased from 2.89% to 0.33%. We are watching this spread extremely closely. This spread has turned negative as the yield curve has inverted ahead of every postwar recession.

Although we continue to monitor all three of these potential risks to the bull market, we remain focused on our main concern: the Fed overtightening. If the yearly change in nonfarm payrolls dips below 1% and the spread between the 10 and 2-year Treasuries dips below 0%, that will likely be the signal that it is time to reduce risk.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.