Nelson Capital Management

Under the Banking Act of 1933 that was enacted during the Great Depression, the Federal Reserve established Regulation Q. This rule, which was in effect until 1986, prohibited interest payments on demand deposit accounts (otherwise known as checking accounts) and set a 5% limit on what banks could pay savings depositors. The late 1960s saw rising inflation and rising interest rates. In 1969, when inflation crossed the 5% threshold, savers effectively began losing money on their inflation-adjusted savings. In 1971, Bruce Bent and Henry Brown established the first money market mutual fund, the Reserve Fund. Like all mutual funds, these were regulated by the SEC and stipulated several requirements: no instrument could be longer than 13 months, the weighted average maturity (WAM) must be under 60 days, most instruments must be investment grade, and no non-government securities position could be over 5%. By the 1970s, these money market instruments were paying well over 5.25%. Consequently, significant disintermediation began, as banks lost their status as the primary intermediaries between savers and the markets. In 1977, Merrill Lynch began offering their cash management account (CMA). This allowed an automatic sweep of brokerage accounts’ cash into a CMA money fund. As a result, a deluge of capital departed the banking industry, establishing money funds as a new intermediary.

Under the Banking Act of 1933 that was enacted during the Great Depression, the Federal Reserve established Regulation Q. This rule, which was in effect until 1986, prohibited interest payments on demand deposit accounts (otherwise known as checking accounts) and set a 5% limit on what banks could pay savings depositors. The late 1960s saw rising inflation and rising interest rates. In 1969, when inflation crossed the 5% threshold, savers effectively began losing money on their inflation-adjusted savings. In 1971, Bruce Bent and Henry Brown established the first money market mutual fund, the Reserve Fund. Like all mutual funds, these were regulated by the SEC and stipulated several requirements: no instrument could be longer than 13 months, the weighted average maturity (WAM) must be under 60 days, most instruments must be investment grade, and no non-government securities position could be over 5%. By the 1970s, these money market instruments were paying well over 5.25%. Consequently, significant disintermediation began, as banks lost their status as the primary intermediaries between savers and the markets. In 1977, Merrill Lynch began offering their cash management account (CMA). This allowed an automatic sweep of brokerage accounts’ cash into a CMA money fund. As a result, a deluge of capital departed the banking industry, establishing money funds as a new intermediary.

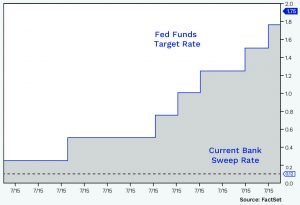

Today, news reports are focused on rising rates, particularly the Federal Funds Target Rate. This rate represents the cost for banks to borrow excess reserves from each other for one day. After seven years of this rate hovering between 0.00-0.25%, the Fed began raising its target in December 2015. In March, the Fed increased its rate for the fifth time, bringing its target to 1.50-1.75%.

Today, news reports are focused on rising rates, particularly the Federal Funds Target Rate. This rate represents the cost for banks to borrow excess reserves from each other for one day. After seven years of this rate hovering between 0.00-0.25%, the Fed began raising its target in December 2015. In March, the Fed increased its rate for the fifth time, bringing its target to 1.50-1.75%.

Short-term market interest rates have increased about 1.5% in response to the Fed’s rate hikes, but they are still below the current rate of inflation. After earning no real return on their cash balances for the better part of a decade, investors read about rate increases in the news and look for higher interest on their bank or brokerage statements, only to find that they are often still only earning a measly 0.12%. Why?

Custodians, after a decade of not earning any fees on money market funds, have closed their funds and forced investors into “bank sweep” vehicles that do not earn market rates. It is almost as if we’ve gone back to the 1960s. Now we have returned to the days before CMA. If we want to earn more than the 0.12%, we have to “buy” a money fund, which currently yields more than 1%. We find it annoying that custodians do not offer an automatic sweep today, although we think it is just a matter of time until an innovative competing firm offers a CMA type of account. We look forward to the ensuing competition.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.