Nelson Capital Management

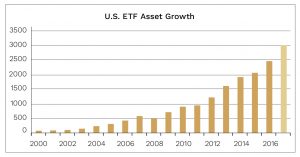

Exchange-traded funds (ETFs) have been around since the early 1990’s, but in recent years they have exploded in popularity. ETFs saw record growth during 2017 in the U.S. as both institutions and retail investors moved money out of traditional mutual funds and individual securities and into ETFs.

ETFs are similar to mutual funds in that they hold baskets of securities, but they differ in that they trade like stocks. Demand for ETFs has increased as they are often cheaper, more tax efficient and easier to trade than equivalent mutual funds. Brokerage firms have responded to increased demand by creating ETFs that track essentially every sector, region and asset class of the equity and fixed income markets. The number of ETFs available to trade in the U.S. has gone from fewer than 100 in 2000 to more than 1,900 at the end of 2016. The increasing popularity of passive investing has helped drive ETF asset growth and has sparked a fee war between firms like Vanguard, Blackrock and Charles Schwab as they try to attract new assets. Approximately $300 billion flowed into ETFs in 2017, with that number estimated to rise to $400 billion in 2018.

When used correctly, ETFs can be a valuable part of a portfolio. However, ETFs with a narrow focus on a particular country or sector hold risks that investors need to be aware of. A lack of in-depth analysis could lead to an investor comparing apples and oranges when looking at ETFs with similar names. For example, Vanguard and Barclays both offer emerging market ETFs, but Vanguard does not consider South Korea as an emerging market country while Barclays does. Also, some ETF providers classify Amazon as a technology company, while others classify it as a consumer discretionary company. These differences often have a material impact on performance.

When used correctly, ETFs can be a valuable part of a portfolio. However, ETFs with a narrow focus on a particular country or sector hold risks that investors need to be aware of. A lack of in-depth analysis could lead to an investor comparing apples and oranges when looking at ETFs with similar names. For example, Vanguard and Barclays both offer emerging market ETFs, but Vanguard does not consider South Korea as an emerging market country while Barclays does. Also, some ETF providers classify Amazon as a technology company, while others classify it as a consumer discretionary company. These differences often have a material impact on performance.

Improved liquidity and lower expense ratios have made ETFs a more attractive tool for portfolio managers to gain diversification and exposure to the equity and fixed income markets. We plan to continue using ETFs to complement our core investment holdings.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.