Nelson Capital Management

In the last few years, we have had events that created significant market declines. The “taper tantrum,” fear of a US Ebola virus outbreak, European deflation, Greek debt, decelerating growth in China (remember the 1,000-point market drop?), Brexit, the drop in oil prices and the US election all caused dramatic, if short-lived, moves in the market. The market sometimes even reacted to events that did not ultimately occur.

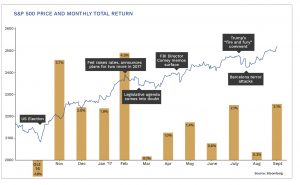

Similar events today seem to have little market impact. We have experienced natural disasters (hurricanes and earthquakes), North Korean nuclear threats and President Trump’s responses, failed healthcare legislation, debt ceiling worries and the Fed’s pivot toward a more restrictive monetary policy. But market participants have donned their “Don’t Worry Be Happy” t-shirts and steadfastly led the market to new highs. In fact, the S&P 500 has had eleven consecutive months in which it has posted a positive return, a winning streak that the US markets have not experienced since 1959.

Why are we seeing widespread market appreciation? As James Carville once said, it’s “the economy, stupid.”

After years of hand-wringing about events that could disrupt a tepid yet persistent economic recovery, markets have gained confidence that this extended period of economic growth will continue.

The current economic expansion is entering its 100th month and growth has shown signs of accelerating. As of June 30, US Gross Domestic Product (GDP) grew 2.2% over the previous year and was up 3.0% when compared to the first quarter of 2017.

The Federal Reserve Open Market Committee (FOMC) has tapped on the brakes several times, raising interest rates twice this year and signaling its intention to raise them for a third time by yearend. More notably, following the FOMC’s meeting in mid-September, there were indications that the FOMC would begin decreasing the size of the Federal Reserve’s balance sheet by allowing its bond holdings to mature without repurchasing a corresponding amount of new bonds. The Fed balance sheet, with less than $1 trillion in holdings in 2007, exploded to $4.5 trillion due to the three-part series of quantitative easing programs. A significant reduction would put material upward pressure on interest rates, perhaps stifling growth. Further analysis of Federal Reserve Chair Janet Yellen’s comments indicates that the accumulated reduction in holdings would total only 10% of the Fed’s balance sheet assets by the end of calendar year 2018. Clearly, the Fed is taking a cautious approach.

The US is not alone in enjoying rising equity markets. Developed international equities are up 20.41% year to date and emerging markets have appreciated 28.03%. Foreign markets, like those in the US, have benefited from a growing economy, an uptick in company earnings and improving employment opportunities. For example, Japan’s economy is growing at a 2.0% annual rate and has had positive wage growth for its workers. The Eurozone unemployment rate has dropped from an average of 13.1% in 2013 to 9.1% this summer. Dollar-to-euro exchange rates have responded to the resurgence in the Eurozone, with the dollar falling 10.96% since January 1, 2017. The decline in the dollar helps make US goods more attractive (cheaper) for foreign buyers.

Inflation in the US has remained surprisingly tame, with the August measure coming in at 1.90%. This in turn has kept bond yields low, with the 10-year US Treasury bond at 2.33%. More importantly, mortgage rates have stayed near historic lows, supporting the housing market. We have long expected an uptick in inflation and a corresponding move in longer term interest rates. Now that growth is occurring across the globe, we think that the catalyst for higher inflation is in place.

As the market hits new highs on an almost daily basis, it is important to focus on stock valuations. Our message remains consistent with our second quarter commentary, when we wrote, “the only thing missing is euphoria.” Stock valuations are not euphoric, but the market is fairly valued. We believe that further stock appreciation from these levels will be driven by growth in corporate earnings. This growth is likely, as we saw S&P 500 company earnings improve 5.9% from the first quarter to the second quarter of this year and a similar sequential improvement is forecast for the second to third quarter of 2017. Confidence is building among stock market participants and within the corporate sector as both domestic and foreign economies demonstrate growth.

The Trump administration has not backed off of its plan to further stimulate the economy with a corporate tax cut and an infrastructure spending plan. Legislative success with either of these two initiatives would provide a further boost to corporate earnings. Given the level of current economic growth and the continued ballooning of the federal deficit, further stimulus seems unnecessary at this time and could cause the economy to overheat.

Individual investment positions detailed in this post should not be construed as a recommendation to purchase or sell the security. Past performance is not necessarily a guide to future performance. There are risks involved in investing, including possible loss of principal. This information is provided for informational purposes only and does not constitute a recommendation for any investment strategy, security or product described herein. Employees and/or owners of Nelson Roberts Investment Advisors, LLC may have a position securities mentioned in this post. Please contact us for a complete list of portfolio holdings. For additional information please contact us at 650-322-4000.

Receive our next post in your inbox.